Digital News Guru Education Desk:

On November 8, 2016, India witnessed a historic event when Prime Minister Narendra Modi announced the demonetization of all Rs 500 and Rs 1,000 banknotes, which made up 86% of the currency in circulation at that time. This move was sudden and unexpected, affecting millions of lives across the country. Now, eight years later, it’s worth reflecting on the impact of this significant economic decision.

What Was Demonetization?

Demonetization means stripping a currency unit of its status as legal tender. When the government demonetized Rs 500 and Rs 1,000 notes, these banknotes were no longer valid for transactions. People had a limited period to exchange their old notes at banks or post offices. New Rs 500 and Rs 2,000 notes were introduced to replace the scrapped currency. The government had a few major goals in mind: to fight black money, curb counterfeit currency, boost the digital economy, and bring more people into the tax system.

Goals of Demonetization

- Curbing Black Money: One of the main reasons given for demonetization was to reduce the amount of unaccounted wealth, or “black money,” circulating in the economy. The hope was that people who had illegally accumulated cash would be forced to bring it out into the open, where it could be taxed.

- Stopping Counterfeit Currency: Another aim was to eliminate fake currency used to fund illegal activities and terrorism. By taking high-denomination notes out of circulation, the government believed it could disrupt these harmful activities.

- Promoting Digital Payments: Demonetization was also expected to accelerate the shift from a cash-based economy to a digital one. With cash temporarily hard to come by, people turned to digital wallets and online banking. This change was supposed to make transactions more transparent and reduce corruption.

- Increasing the Tax Base: The government hoped demonetization would make more people and businesses pay taxes. If people deposited large amounts of money into their bank accounts, these deposits could be scrutinized, and unaccounted income could be taxed.

Immediate Impact on the Economy and People

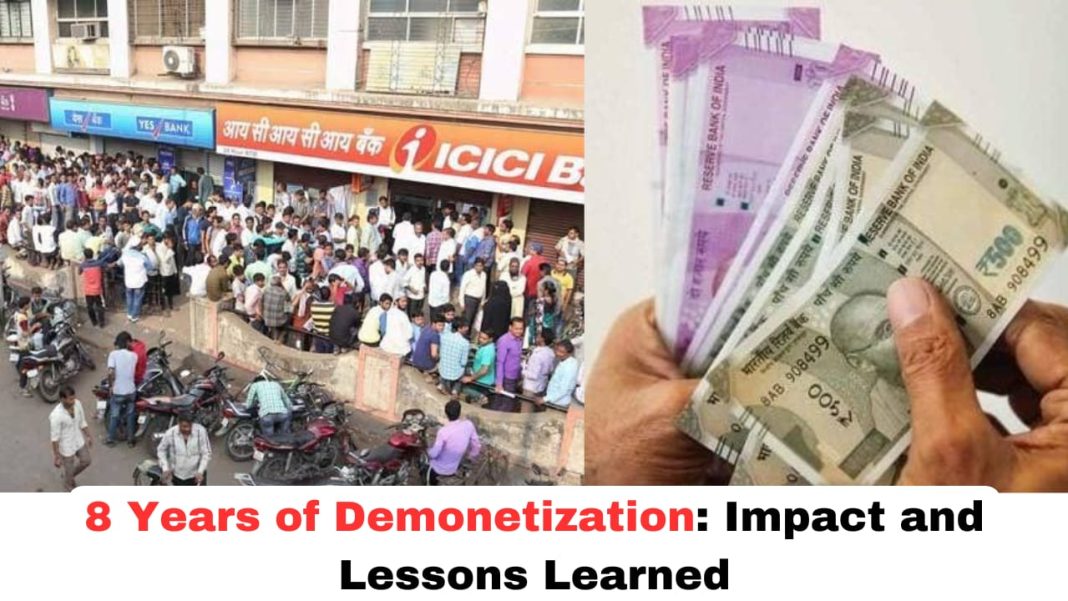

Demonetization had a mixed impact. The most immediate effect was a severe cash crunch. People lined up outside banks for hours to exchange their old currency notes. Small businesses and daily wage workers, who relied heavily on cash, faced significant hardships. Many of these workers lost their jobs, and some businesses shut down. Rural areas, where digital payments were not as common, were particularly affected.

The economy took a temporary hit, with GDP growth slowing in the months following demonetization. However, supporters of the move argued that this was a short-term pain for long-term gain. They believed that the benefits would become evident over time as black money was reduced and more people joined the formal economy.

Long-Term Effects of Demonetization

- Cash Back in Circulation: Despite the effort to reduce cash in the economy, cash usage eventually rebounded. The Reserve Bank of India (RBI) reported that by 2022, the total amount of cash in circulation was even higher than before demonetization. This raised questions about the effectiveness of the measure in reducing dependency on cash.

- Digital Payments Growth: On the positive side, demonetization did spur a significant rise in digital transactions. The use of digital payment platforms like UPI (Unified Payments Interface), Paytm, and others increased dramatically. Even small vendors started accepting digital payments, which was a notable shift for a largely cash-based society. India has since seen steady growth in digital banking and financial technology.

- Increase in Taxpayers: The tax base in India did expand. More people started filing tax returns, which helped increase the government’s revenue. However, some critics argue that this increase was not as substantial as expected, and the overall tax-to-GDP ratio has remained relatively low.

- Effect on Black Money: The impact of demonetization on black money remains unclear. According to the RBI, almost all of the demonetized currency was returned to the banking system, which implies that the expected “windfall” of unaccounted money did not happen. However, the government contended that even if black money was deposited, it would be traceable and taxable. Still, the exact extent to which this strategy worked is debatable.

- Impact on Informal Economy: The informal sector, which employs a large portion of India’s workforce, suffered a lot. Many small traders and daily wage earners faced financial difficulties due to the cash shortage. The loss of jobs and temporary economic slowdown had a lasting impact on some families.

Criticisms and Support

Demonetization has been one of the most polarizing policies in India’s recent history. Critics argue that the disruption it caused was not worth the benefits. They point out that demonetization did not eradicate black money, as most unaccounted wealth is held in assets like real estate and gold rather than cash. The move also caused immense inconvenience to ordinary citizens, and the economy took years to fully recover.

On the other hand, supporters believe that demonetization brought structural changes to the economy. They argue that it created a push for digital payments and made people more aware of the need for formal banking. It also sent a strong signal about the government’s commitment to fighting corruption, even if the results were mixed.

Conclusion

Eight years after demonetization, its legacy is a complex one. The move certainly had a transformative impact on how Indians think about money, prompting millions to explore digital payments and financial technology. However, whether it achieved all its goals, especially in terms of curbing black money and counterfeit currency, is still up for debate. The experience of demonetization has become a significant case study in economic policy, showing both the potential benefits and the risks of such bold decisions. As India moves forward, the lessons learned from this episode will continue to shape discussions on economic reforms and strategies.

You May Also Read: ECI rescheduled by-election in Kerala, Punjab, Uttar Pradesh: Here’s Why November 20 Is the New Date