DIGITAL NEWS GURU NATIONAL DESK :-

The Unified Pension Scheme’s Impact on India’s Pension Landscape !

The Unified Pension Scheme (UPS) has recently gained significant attention following its approval by the Indian Union Cabinet, marking a major shift in the country’s pension policy. Set to be implemented from April 1, 2025, the scheme aims to provide greater financial security to government employees, while also addressing longstanding concerns related to the sustainability and adequacy of pension provisions in India.

However, the scheme has also sparked considerable debate, with both praise and criticism coming from various quarters. This article explores the latest developments surrounding the UPS, examining its key features, the rationale behind its introduction, and the controversies it has stirred.

Key Features of the Unified Pension Scheme:

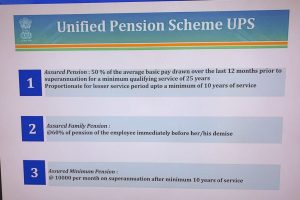

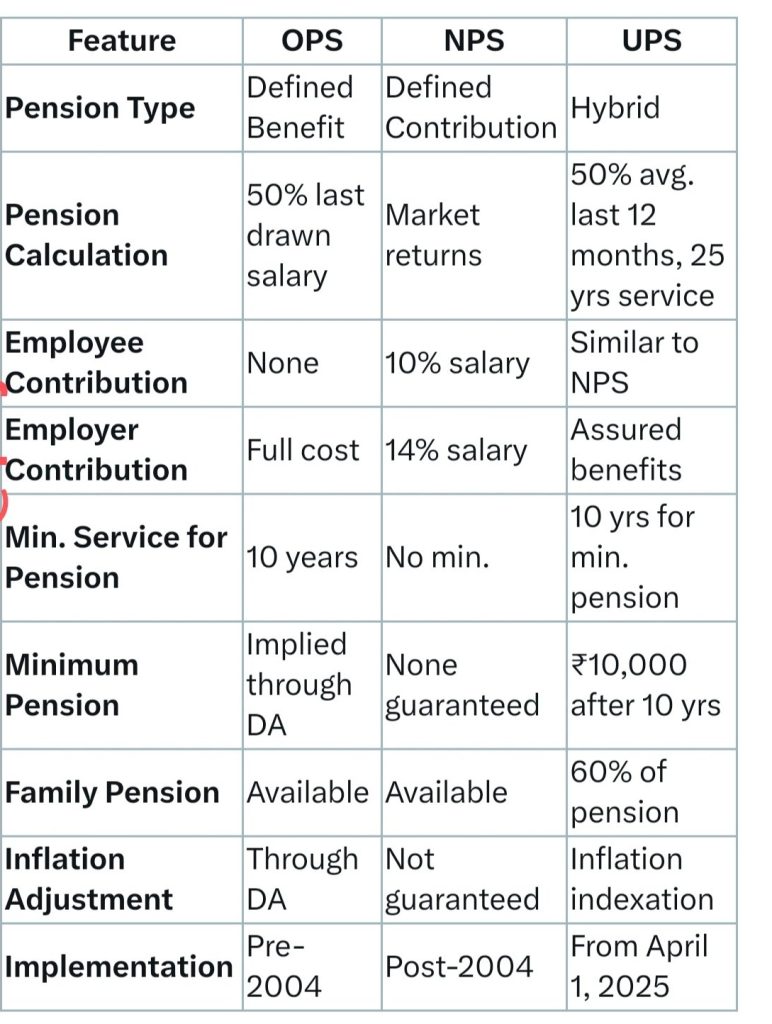

The UPS represents a hybrid approach, combining elements of both the traditional Defined Benefit (DB) and the modern Defined Contribution (DC) pension systems. One of the central features of the UPS is the assured pension, which guarantees 50% of the average basic pay drawn over the last 12 months of service as a pension.

This benefit is contingent on the employee completing at least 25 years of service. For those with shorter service periods, the pension will be proportionately reduced, with a minimum pension guaranteed for those with at least 10 years of service.

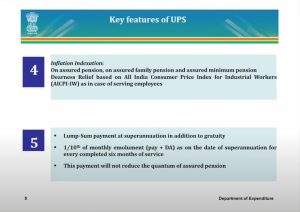

In addition to the basic pension, the UPS includes a family pension component. If an employee passes away, their family will receive 60% of the pension the employee was entitled to. Furthermore, the scheme incorporates mechanisms to adjust pensions for inflation, ensuring that the purchasing power of retirees is maintained over time.

Voluntary Participation and Transition Options:

A significant aspect of the UPS is its optional nature for current government employees enrolled in the National Pension System (NPS). The NPS, introduced in 2004, is a defined contribution scheme where the pension amount depends on the contributions made during an employee’s career and the returns generated by those investments.

Unlike the NPS, which is subject to market risks, the UPS offers a more predictable retirement income, making it particularly appealing to employees who prefer financial security over potential market-driven gains.

Employees under the NPS have the option to switch to the UPS if they find the latter’s guaranteed benefits more attractive. This flexibility is seen as a way to accommodate different risk preferences and financial needs among government employees, allowing them to choose the retirement plan that best suits their circumstances.

Rationale Behind the Unified Pension Scheme:

The introduction of the UPS is part of the Indian government’s broader effort to reform the pension system in light of changing demographic and economic realities. One of the main motivations behind the UPS is the need to address the concerns of government employees who have been advocating for more secure retirement benefits.

The NPS, while popular among some, has been criticized for exposing employees to market risks and for potentially lower returns compared to the older, guaranteed pension schemes.

By offering a hybrid model, the government aims to strike a balance between sustainability and adequacy of pensions. The UPS is designed to be more financially sustainable than the traditional DB schemes, which are increasingly seen as unsustainable due to the growing number of retirees and rising life expectancy.

At the same time, it seeks to provide more security than the NPS, addressing the concerns of employees who are wary of market volatility.

Controversy and Opposition:

Despite its advantages, the UPS has not been without controversy. Critics argue that the scheme does not go far enough in addressing the demands of government employees who have been calling for a return to the Old Pension Scheme (OPS).

The OPS, which was in place before 2004, guaranteed 50% of the last drawn salary as a pension, fully funded by the government. In contrast, the UPS still requires employee contributions and offers a lower guaranteed pension, leading some to view it as a compromise rather than a full restoration of the OPS.

Political opposition to the UPS has also been significant, particularly from non-BJP-ruled states and employee unions. Several states have either reverted to the OPS or are actively campaigning for its reinstatement, arguing that the UPS does not provide adequate financial security.

These states and unions have expressed concerns that the new scheme could leave retirees worse off, particularly in an inflationary environment where the real value of pensions could erode over time.

Moreover, the transition provisions have also come under scrutiny. Some argue that the optional nature of the scheme creates uncertainty and could lead to confusion among employees about which scheme to choose.

There are also concerns about the administrative complexity of managing multiple pension systems simultaneously, especially during the transition period.

Government’s Response and Future Prospects:

In response to the criticism, the government has defended the UPS as a necessary reform to ensure the long-term sustainability of the pension system while also addressing the legitimate concerns of employees.

Officials have highlighted the scheme’s flexibility, its inflation-adjusted benefits, and the financial prudence of requiring contributions to fund future pensions.

The government has also emphasized that the UPS is part of a broader effort to modernize India’s social security framework, making it more inclusive and resilient in the face of economic challenges.

By offering a middle path between the old DB schemes and the NPS, the UPS is seen as a way to gradually transition towards a more sustainable pension system without abandoning the principle of providing a secure retirement for all government employees.

However, the future of the UPS remains uncertain, particularly in light of ongoing political opposition and public protests. The scheme is likely to be a major topic in upcoming elections, with different political parties and states taking varying positions on its merits.

As the April 2025 implementation date approaches, the government will need to carefully manage the transition process and continue to engage with stakeholders to address their concerns.

Conclusion:

The Unified Pension Scheme represents a significant shift in India’s approach to pension reform, offering a hybrid model that seeks to balance financial sustainability with the need for secure retirement benefits. While the scheme has been praised for its innovative approach and potential to provide greater security for government employees, it has also faced considerable criticism and opposition.

As the debate continues, the success of the UPS will depend on the government’s ability to navigate the complex political landscape, address the concerns of critics, and ensure a smooth transition to the new system. The coming months will be crucial in determining the ultimate impact of this landmark reform on India’s pension landscape.

YOU MAY ALSO READ :- Maneka Gandhi Birthday special : विवादों और लाइमलाइट से हमेशा दूर रहती है मेनका गाँधी, अपने से 10 साल बड़े संजय गांधी से करी थी शादी !