Enforcement Directorate :-

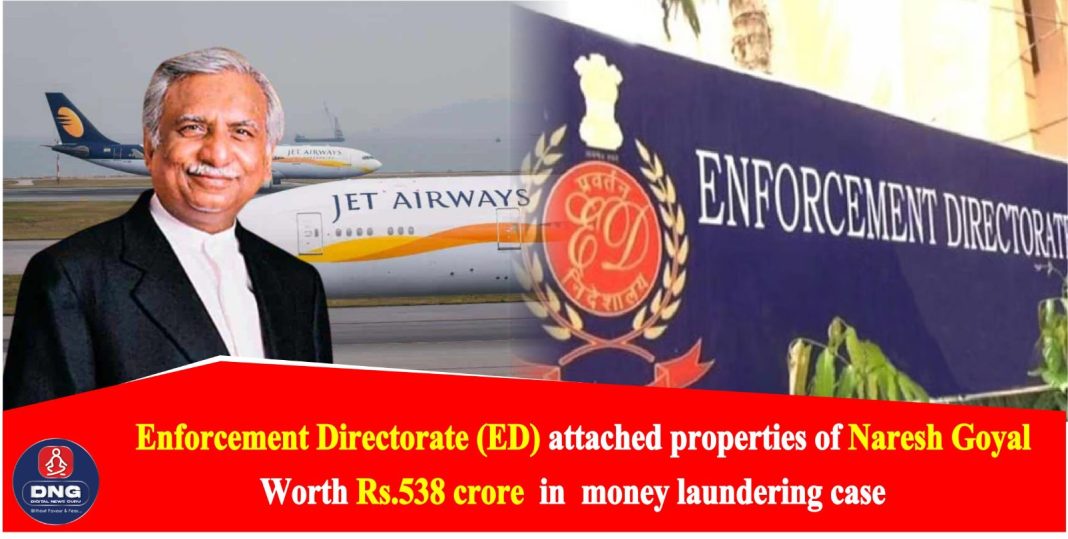

DIGITAL NEWS GURU BUISNESS DESK :- The Enforcement Directorate (ED) attached properties of Naresh Goyal,worth Rs.538 crore in the money laundering case, who is the owner of Jet Airways India (Ltd) . The properties include 17 residential flats- bunglows, commercial properties in the name of several companies such as Jetair Pvt. Ltd. , Jet Enterprises Pvt. Ltd. etc and in the name of his wife, Anita Goyal and son Nivaan Goyal. The ED has said that these various properties are situated in London, Dubai and various states of India.

What’s the matter :-

The Canara Bank alleged to the Naresh Goyal for the fraud of Rs. 538 crore . The Crime Bureau of Investigation (CBI) also registered First Information Report (FIR) against Jet Airways, Naresh Goyal, his wife Anita Goyal and other former company executives on May after Canara Bank allegations. The Naresh Goyal was arrested by the Enforcement Directorate (ED) under the prevention of Money laundering case on 1 September linked to loans and credit lines given to the airline by Canara Bank. He was arrested by ED and lodged in Mumbai Jail popularly known as Arthur Road Jail. Naresh Goyal 74, is currently in the judicial custody which is also extended.

Jet Airways :-

Jet Airways is a private aviation company which was founded by Naresh Goyal on 1 April 1992. Its headquarter is based on Delhi and training and developmental centre is situated in Mumbai. This Airline company has started its work as a air taxi operator in 1993 and began its full-fledged operation in 1995 and international flights were added on 2004.

Jet Airways came as private company after the introduction of the “Open Sky policy” by the government in 1992 that means private companies can enter into the airline industry. Then the Jet Airways company started growing at the very fast rate and in the 1996-97 it became the 2nd largest Airlines company and remain till 2002. Jet Airways was a full service company which bought Air Sahara at the cost of Rs1440 crore and made it a low cost carrier.

Jet Airways crises:-

In 2004 government has introduced a 5/20 rule that means a company which is running from past 5 years and have at least 20 aircraft then they can start their international flights. As a result Jet Airways shifted their focus towards international market from domestic market which gave profit to various other low cost carrier. By expanding their money to buy Air Sahara and various aircrafts they suffered heavy losses which results as they found difficulty to pay their dept which was about of Rs8000 crore and later they also suffered heavy losses of atleast Rs3000 crore.

Revival of Jet Airways:

In 2019, Jet Airways faced severe bankruptcy. The debt amount was approximately Rs. 18000 crore, which is a huge amount. In 2020, the investment company Kalrock took over Jet Airways in view of the revival of Jet Airways in 2022, which did not happen due to financial problems and ongoing proceedings with the National Company Law Tribunal (NCLT). The new promoters have completed their investment of Rs. 100 crore by taking the total investment to Rs. 350 crore.

The airline is expected to start its operations in 2024 as the Jalan-Kalrock consortium has completed its investment of Rs. 350 crore to revive the airline. Earlier this year, the National Company Law Tribunal (NCLT) approved the transfer of the ownership of this airline to the Jalan-Kalrock consortium, in which Murari Jalan, a businessman from the UAE, and Kalrock, a UK-based company, and in July, the Directorate General of Civil Aviation (DGCA) renewed the operation certificate of Jet Airways.

YOU MAY ALSO READ :- वर्ल्ड कप 2023 के सेमीफाइनल में पहुंची भारतीय टीम,श्रीलंका को 55 रनों पर किया ढेर