Digital News Guru Business Desk:

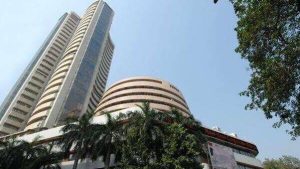

Indian Stock Market 2025: Growth Opportunities and Key Risks

As we approach 2025, the Indian stock market presents a complex landscape shaped by various economic indicators, policy decisions, and global events. Investors are keen to understand the potential trajectories and sectors that may offer promising returns in the coming year.

Economic Growth Projections

India’s economy is anticipated to maintain robust growth, with projections indicating a GDP expansion of approximately 6.5% in 2025. This growth is expected to be supported by strong domestic demand, increased infrastructure spending, and a burgeoning digital economy. However, challenges such as persistent inflation and potential delays in public spending due to upcoming elections could pose risks to this outlook.

Monetary Policy and Interest Rates

The Reserve Bank of India’s (RBI) monetary policy will play a crucial role in shaping market dynamics. With global central banks, including the U.S. Federal Reserve, signaling a slower pace of interest rate cuts, the RBI may adopt a cautious stance to balance inflation control with the need to support economic growth. This approach could influence liquidity conditions and investor sentiment in the equity markets.

Sectoral Outlook

- Financial Services: The banking sector has shown steady growth, with the Nifty Bank index delivering a year-to-date return of around 8% in 2024. Analysts are optimistic about the sector’s performance in 2025, citing improved asset quality and credit growth. However, competition and regulatory changes remain key factors to monitor.

- Information Technology (IT): Indian IT firms, with significant revenue exposure to the U.S. and Europe, may face headwinds due to global economic uncertainties and currency fluctuations. Nonetheless, the ongoing digital transformation across industries presents opportunities for growth, particularly in areas like cloud services and cybersecurity.

- Healthcare: The healthcare sector, especially hospitals, is expected to be a significant investment theme in 2025. Factors such as increasing healthcare awareness, government initiatives, and rising demand for quality medical services are likely to drive growth in this sector.

- Engineering and Infrastructure: With the government’s focus on infrastructure development, sectors related to engineering and construction are poised for expansion. Investments in smart cities, transportation, and renewable energy projects could provide substantial opportunities for companies in this space.

Market Valuations and Investment Strategies

Elevated market valuations suggest that investors should exercise caution. Diversification beyond the Nifty 50 stocks into mid-cap and small-cap segments may offer better risk-adjusted returns. Additionally, following reputable private equity funds and focusing on sectors with strong growth prospects could be prudent strategies for 2025.

Global Factors and Foreign Investment

Global economic conditions, particularly in the U.S. and China, will have implications for the Indian stock market. India’s recent surpassing of China in the MSCI All-Country World Investable Market Index reflects increased investor confidence and liquidity in Indian markets. However, geopolitical tensions and global economic slowdowns could impact foreign investment flows.

Risks and Considerations

- Inflation: Persistent inflation could erode corporate profit margins and consumer purchasing power, affecting overall economic growth and market performance.

- Political Uncertainty: With general elections on the horizon, policy uncertainties may lead to market volatility. Investors should be prepared for short-term fluctuations driven by political developments.

- Global Economic Slowdown: A slowdown in major economies could dampen demand for Indian exports, affecting sectors like IT and manufacturing.

Conclusion

The Indian stock market in 2025 is poised for growth, supported by strong economic fundamentals and sector-specific opportunities. However, investors should remain vigilant regarding potential risks, including inflation, political uncertainties, and global economic conditions. A diversified investment approach, focusing on sectors with robust growth prospects and sound valuations, is advisable to navigate the complexities of the coming year.

You May Also Read: Victoria Terminus: The Historical and Architectural Marvel of Mumbai